Over the past few weeks, we published blogs detailing lessons learned from the Amazon v IRS tax case: The CUT Method of Transfer Pricing is Not Dead and Know Your Transfer Pricing Data. This week we’ll dig into the final of three lessons: how to conduct a wise royalty rate calculation.

A Tale of Two Rates

The most important question you can ask yourself regarding the selection of the final agreement rate is:

“does it meet the facts of the tested transaction?”

Many practitioners rely on their database providers to give them a single rate per agreement. However, depending on the facts of your transaction, the selection of the royalty rate is not always that simple.

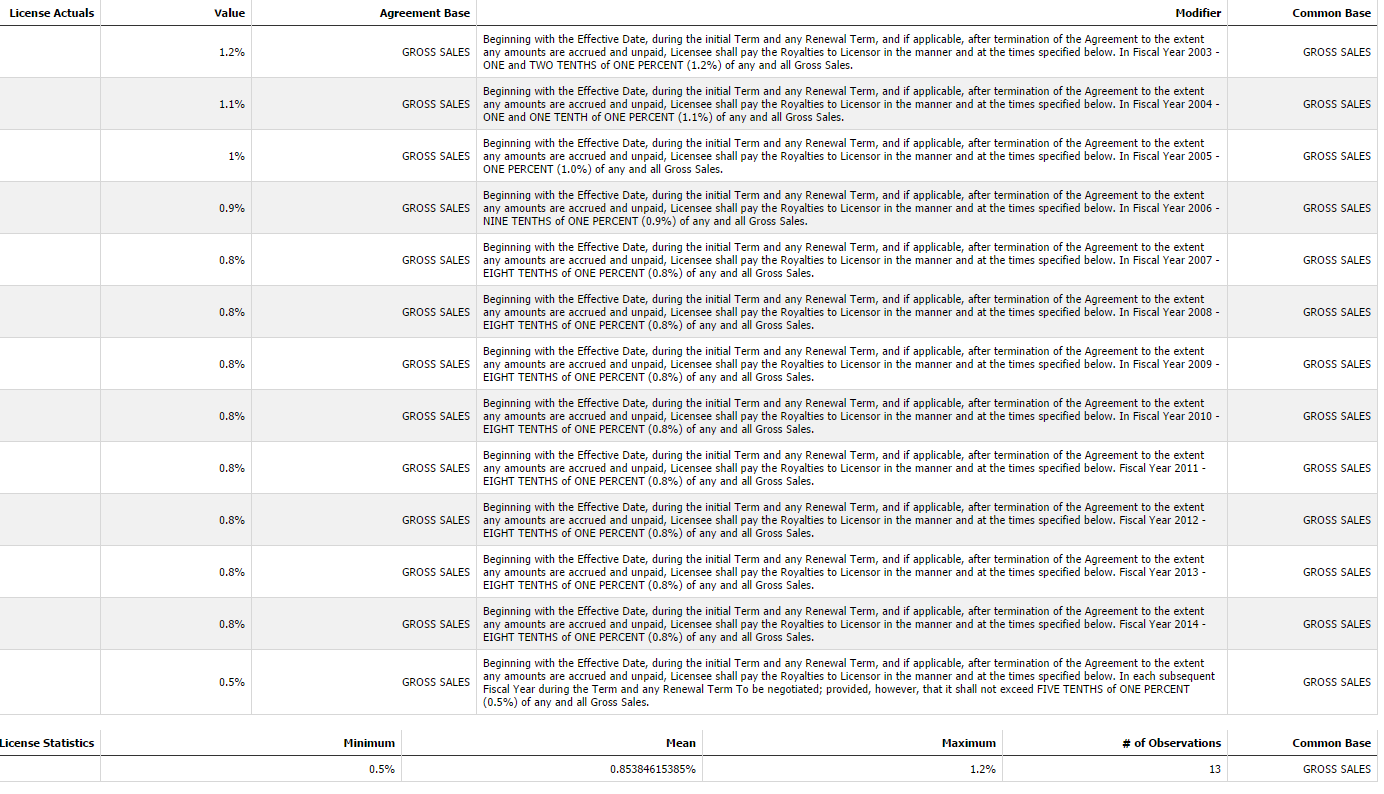

For example, in the Amazon case, we can evaluate the royalty rate selection for the Sports Authority license agreement. While the opposing experts chose the same agreement, the two sides derived different royalty rates. This particular agreement specified royalty rates declining from the initial year at 1.2%, to 0.5% over the next twelve years. This can be seen in the image below:

Click for a larger image. Source: ktMINE Royalty Rates

Click for a larger image. Source: ktMINE Royalty Rates

While one expert elected to use the highest rate, the court and the other expert elected to use a simple average of the rates in the agreement. It is also possible to use the lowest rate for an analysis, but no one opted for this choice. Additionally, we’ve seen customers elect to use a weighted average based on sales volumes or profits, depending again on the transaction.

As you can see, many of these royalty rate calculation methods would not be possible if only one rate was relied upon. It’s important to understand the royalty rates of agreements in comparison to your transaction before selecting the final rate. This will allow you to better defend your choice, and protect yourself during audit and litigation.

Big Picture Data

In order to perform an analysis as outlined in the Amazon case, analysts need access to a royalty rate database offering full-text documents and valuable summaries of all the disclosed royalty rates. Relying on a database that only provides a single rate per document can lead to incorrect assumptions that do not fit all transaction facts.

ktMINE analysts and technologists build products that allow analysts to make these decisions and to have the data to calculate these rates. While other providers may only offer the highest rate, ktMINE provides each individual rate in a clean and user-friendly format.