The year 2019 has come and gone, and in the world of intellectual property, that means a number of agreements have been signed and put in effect. Here at ktMINE, agreements are continuously being analyzed and added to our robust database offered within the ktMINE Search and Agreement Applications. Today, we examine a couple of agreements with notable companies to see how useful the details offered in agreements can be.

Disney Bought Twenty-First Century Fox

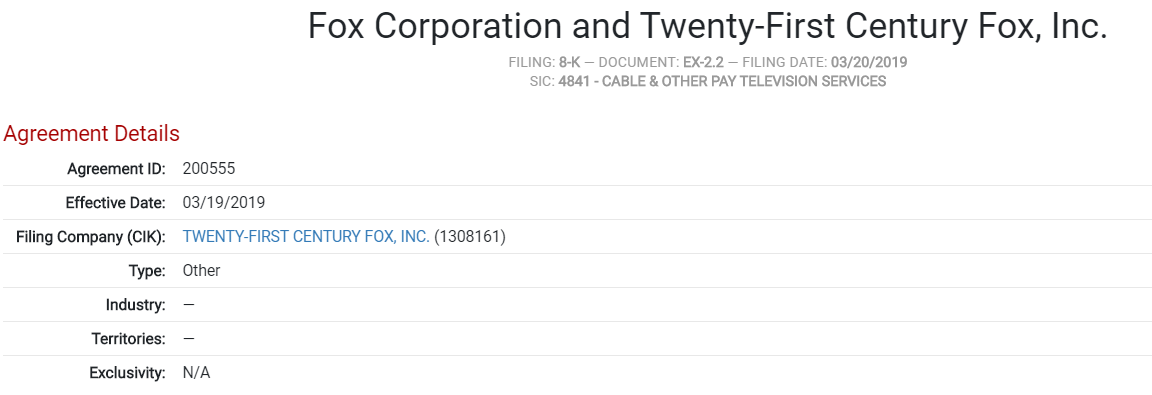

The first agreement dated March of 2019 is regarding the separation of Twenty-First Century Fox, Inc, the parent company, from its child, Fox Corporation. This is accomplished through the transfer of Twenty-First Century’s ownership of “FOX Assets” to Fox. FOX Assets includes not only those of Fox, Inc but the assets of all of its subsidiaries as well. Included in the Assets are “the “Fox” name and any and all “Fox” brands and related Trademarks;” its “Television segment;” and various sports-related channels.

The “SEPARATION AND DISTRIBUTION AGREEMENT” as seen in the Agreements dataset within the ktMINE Search App.

In accordance with the agreement, this separation is to take place prior to the merging of Twenty-First Century into a subsidiary of TWDC Holdco 613 Corp, parent of The Walt Disney Company. This separation agreement was made over a year after the “Disney Merger Agreement” and its respective press release, both made in December of 2017. Given the “consummation” of the merger is to occur only after the separation is engaged, the finalization of Fox as an independent company, and Twenty-First Century Fox as an affiliate of Disney seems to have occurred more recently then let on by the date of the Merger Agreement.

Expedia Gained Yet Another Company

Qurate Retail, Inc (formerly known as Liberty Interactive Corporation) was involved in around a dozen agreements in 2019. Most of Qurate’s involvement can be found within an SEC filing by Liberty Expedia Holdings, Inc, dated April of 2019. Though not made explicit, the agreements are a result of Liberty Expedia being acquired by Expedia Group, Inc (owners of multiple well-known travel servicing websites like trivago, Hotels.com, Hotwire). This is evident because the multiple agreements involving Qurate and Liberty Expedia from this fling are amendments made to incorporate Expedia Group.

The “AMENDMENT NO. 2 TO TRANSACTION AGREEMENT” as seen in the Agreements dataset within the ktMINE Search App.

Qurate’s relation to Liberty Expedia is initially unclear from the filing alone, as the merger agreement does not explain well the background of the two companies; in fact, the merger states “none of Qurate, the Company, Parent or Diller shall be deemed to be Affiliates of each other or their respective Affiliates.” But the relationship is obviously extensive due to the number of agreements they are involved in together. Clarity to this was found by tracing backward from an amended transaction agreement (seen above) to its earlier version filed in September of 2016. In this agreement, it states Liberty Expedia as a “wholly owned subsidiary” of Qurate. It also contains Qurate’s stock ownership of Expedia, Inc, the former name of Expedia Group, Inc. Further, within this 2016 filing contains the subsidiaries of Liberty Expedia, and it is through Liberty Expedia that Qurate at one point had ownership of Expedia Group. This explains why there would be multiple amendments involving Qurate, and Liberty Expedia’s name similarity to both Expedia and Qurate’s old name.

What to Take Away From M&As

Mergers and acquisitions make up a significant amount of the non-royalty rate agreements filed to the SEC. These agreements can be insightful in terms of its details. From the Disney Merger, we found a more precise time frame in which the merger took legal effect, and the portion of assets actually being acquired (since Twenty-First Century Fox did not come with its well-known subsidiary). Additionally, for those unfamiliar with the M&A process, we also see it used as a method to incorporate an existing company; that is to merge the acquired entity into one which the acquirer already owns. Even with the common knowledge, there is always something to dig further into than what is said in the press.