In part two, we talked about the importance of bankruptcies as asset transfer indicators and discussed the available options banks may have when contemplating the monetization of IP assets. In part three, we will wrap up this series with a discussion of cash and debt data when combined with patent data may serve to identify those entities that might be in the market for acquiring or divesting, and how banks might serve as a touchpoint that is common to these activities.

Who are the Players?

An easy answer might be that companies with leveraged portfolios, oversized debt positions, and little cash would be candidate asset “sellers”. Correspondingly, those companies with large cash holdings and little debt would be candidate asset “buyers.”

But it might be more complicated than that. Not every hospital-bed manufacturer is interested in acquiring an energy company. So, a deeper understanding of the players in each market will be required to best understand which are in the best position to acquire and which are best suited to divest. From an acquisition perspective, this will help to identify which companies are likely to travel outside of their traditional areas. But these are unusual times, and perhaps an attractive price will provide enough incentive for some to explore more now.

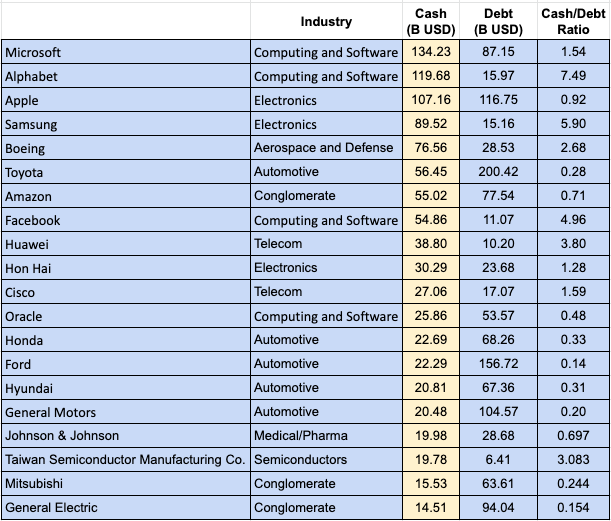

Let’s look at cash first:

Who is likely to explore? Certainly, those that have explored before, and those companies with deep cash positions. Smarter companies will have acquired their cash on the cheap and so may have more degrees of freedom in which to operate. From Table 1, it is plain to see that Microsoft, Alphabet, and Apple are holding tremendous amounts of cash, with each holding more than $100B USD.

Table 1: Top Entities by Cash Holdings

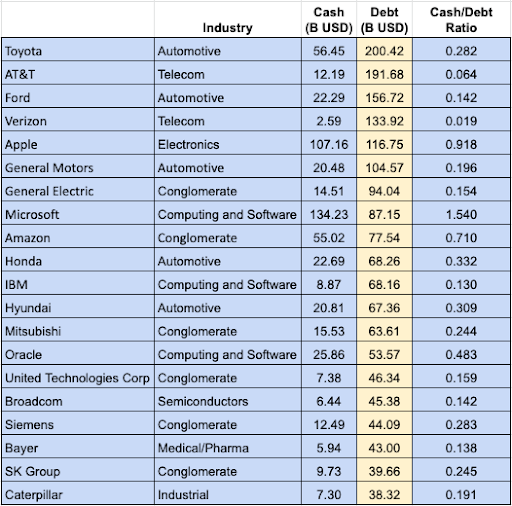

Debt:

Debt by itself is not necessarily a measure of failure, but depending on the circumstances, it may be seen as an indication of stress. This may translate as a more costly liability now that markets and liquidity have dried up. From Table 2, it is interesting and maybe surprising that Apple is holding so much debt.

Table 2: Top Entities Holding Debt

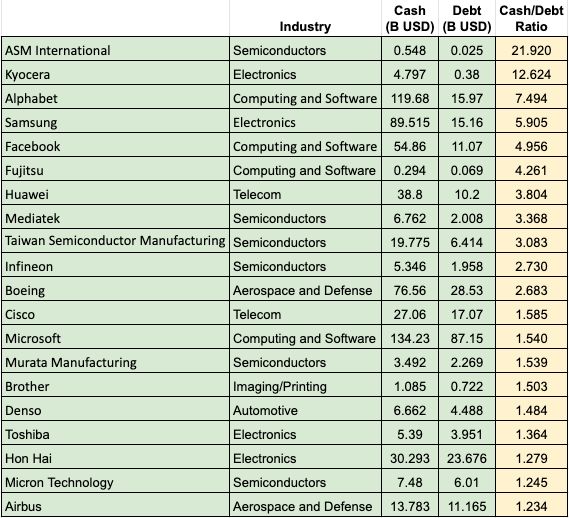

Cash-to-debt:

Again, debt may not be a bad thing, especially if a company has the cash to cover it. A cash-to-debt ratio of 0.2 or higher suggests that a company can pay down its debt in 5 or fewer years. Table 3 shows entities that have large cash-to-debt ratios and so can easily address issues associated with their debt.

Table 3: Top Entities with High Cash-to-Debt Ratios

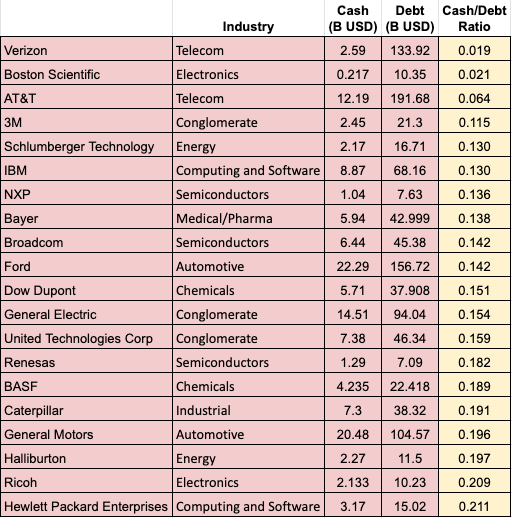

Paying down debt in five years might have been a manageable feat in the recent past, but perhaps this is a shaky proposition now. Table 4 shows those entities that have low cash-to-debt ratios and may find it difficult to address debt issues.

Table 4: Top Entities with Low Cash-to-Debt Ratios

That said, there may be plausible explanations for high debt or a low cash-to-debt ratio. Some industries are capital intensive. For example, Verizon, AT&T, and other telecoms invest tremendous amounts to install and maintain the national networks that just about everyone enjoys. All things considered, it seems unlikely that their near-term revenues will decline since everyone agrees as to the importance of their services. The same is true for pharmaceutical entities or those otherwise involved with medicine.

On the other side of the coin, there are those entities that are intrinsically dependent upon travel or transportation that might find the current world challenging (energy, aeronautics, and the like).

Back to Banks

And this brings us full circle back to banks: If those companies that have already leveraged their IP portfolios find the current environment too challenging, banks may be forced to deal with those assets. Table 5 shows a list of entities associated with large assignment transactions within the last few years. A quick look through the industries will help develop a broad-level interest position.

Table 5: Entities with assignment tranches of 1000 or more U.S. patents since 2015

Considering the valuation of a single patent, let alone a patent portfolio, more diligence will be required to properly identify a transactional match. The next steps might include detailed analyses that show how these patent portfolios align with prospective buyers or licensees, a look at the patent or portfolio itself for infringement or validity issues, and finally, capping off with a valuation determination.

Because of their relationships with those financing debt or collateralizing assets or those entities that are investigating investment opportunities, banks are in a unique position to facilitate an IP transaction. Banks are accumulating impressively-sized patent holdings, which may foreshadow upcoming economic and technological trends. By exercising an influence on where an asset goes, banks may be able to direct or otherwise control future invention efforts. Does this represent a shift in the innovation paradigm? Possibly. In any case, it will be insightful to look to them for activity on patents and that is something you can bank on.