From part one, we observed that during the past decade, banks have amassed impressive patent portfolios. In part two, we will look at other data sets to examine options that banks may explore when transacting patents.

Bankruptcy is a definitive indicator of financial performance and may forecast the transfer of IP assets.

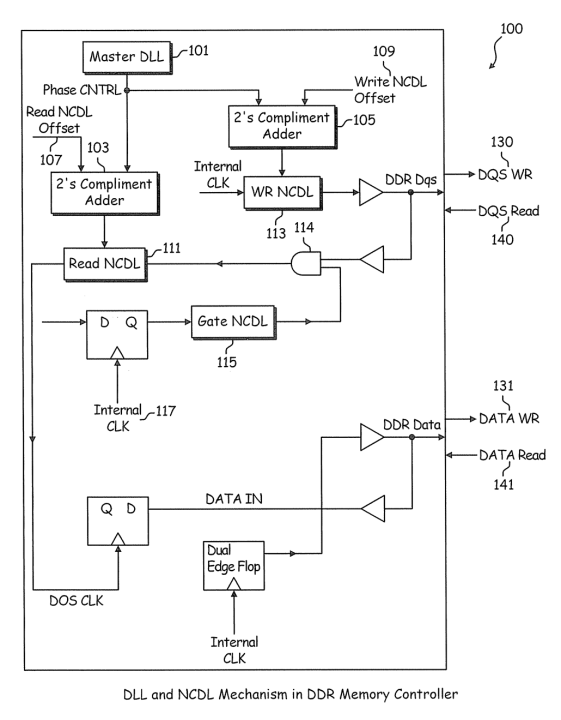

In 2019, bankruptcies appeared to be trending downward, perhaps indicating that the various collateral agreements were still intact and no major liquidation of assets was underway.

Chart 1: United States Bankruptcies

source: https://tradingeconomics.com/united-states/bankruptcies

That said, considering that the impact of COVID-19 upon the economies of the world began in late February 2020, it is not a stretch to suggest that bankruptcies are likely to pick up. Banks may already be considering foreclosing on transactions and seizing assets.

Options

The emerging economic turmoil may leave banks attempting to monetize these assets themselves either by litigating for infringement, by licensing, or by selling them into the market, all during a time when global commerce is effectively stunted.

Litigation:

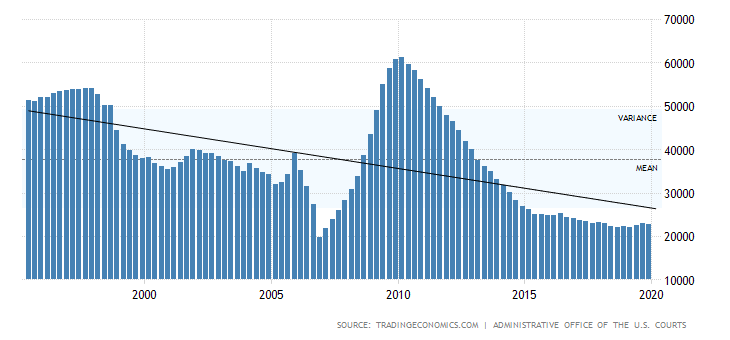

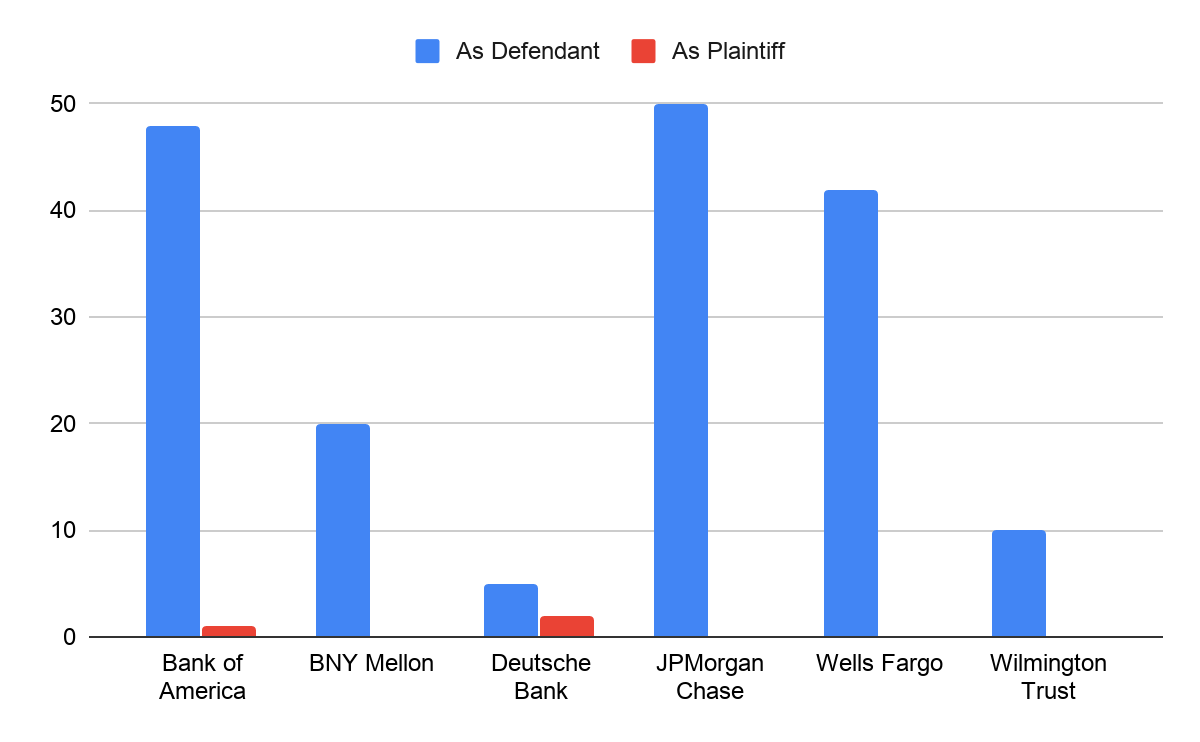

From a litigation perspective, it seems unlikely that a bank would take on the burden of litigating an asset that is unrelated to their business. For the most part, banks have been on the receiving side of patent litigation and not on the assertion side.

Chart 2: Patent LItigation Since 2010

source: PACER, Litigations with Nature of Suit = 830, via ktMINE

Licensing:

Similar to litigation, there are challenges associated with banks licensing assets that are unrelated to their business. It may not be practical to license out technologies where the bank does not have direct subject matter expertise. Transaction data (from the SEC, SEDAR, and HK Exchange) shows that, historically, banks have not engaged in any substantive patent licensing campaigns. Considering that licensing can be a time-consuming process, the banks may not have the patience to effectively explore this monetization path.

Sales:

This leaves sales as an obvious option for banks to either offload or otherwise monetize patent assets. However, there are challenges here too. Given the current state of economic affairs, the list of entities interested in acquiring patent assets might be a little thin.

Additionally, those banks that belong to defensive or non-aggression networks (such as LOTNET) may find valuation challenges once they take full ownership. Due to the encumbrances brought on as part of their memberships, they may be required to extend licenses to other members if the buyers are considered to be patent assertion entities (LOTNET), and, arguably, this may lessen the value they might otherwise obtain from such a sale.

This leaves us to wonder…

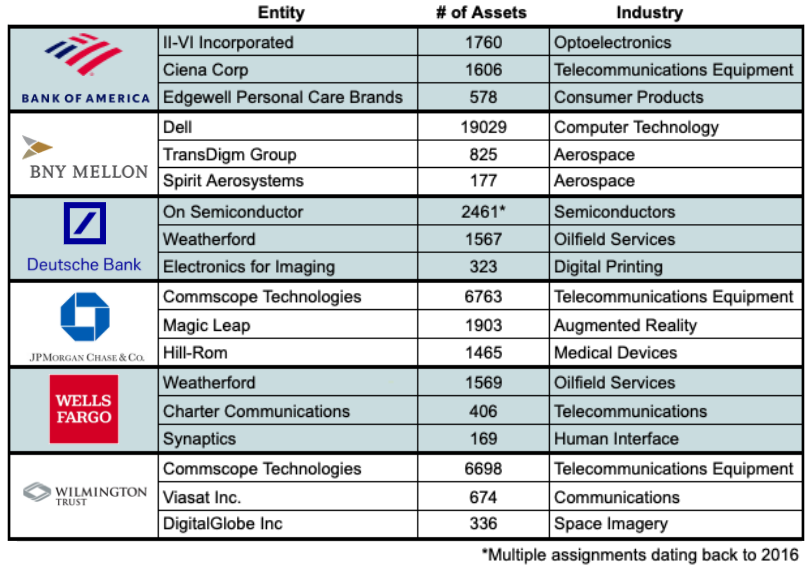

Because there are foreign assets and markets to consider and because transactions are not uniformly recorded across all jurisdictions, assignments can only tell so much. But we can take a broad level look at recent U.S. assignments. In Table 1, we observe that each bank has been involved in multiple IP transactions within the past 20 months.

Table 1: Key Assignment Transactions Since 2019

source: USPTO assignment data via ktMINE

Under the current market conditions, we can contemplate where on the spectrum segments are likely to lie, ranging from “medical-related” to “anything involving large gatherings of people” and all things in between. Also, market and competitive elements, along with liability positions will motivate banks to consider alternatives should their traditional sources of revenue lag, with each bank having a different threshold.

Next time, we will wrap up by identifying likely transaction candidates (both acquiring and divesting) and touch on the importance of liquidity.