Agreements are made for various reasons such as licensing and purchasing patents/assets, developing products, employment and so on. In the ktMINE Agreements App, you can find over 100,000 agreements, each of which has been individually analyzed to showcase a snapshot of relevant information. Among all the types of agreements, of interest to many are those related to technologies. Some noteworthy emerging technologies today are artificial intelligence (AI), virtual reality (VR), and blockchain.

Source: ktMINE

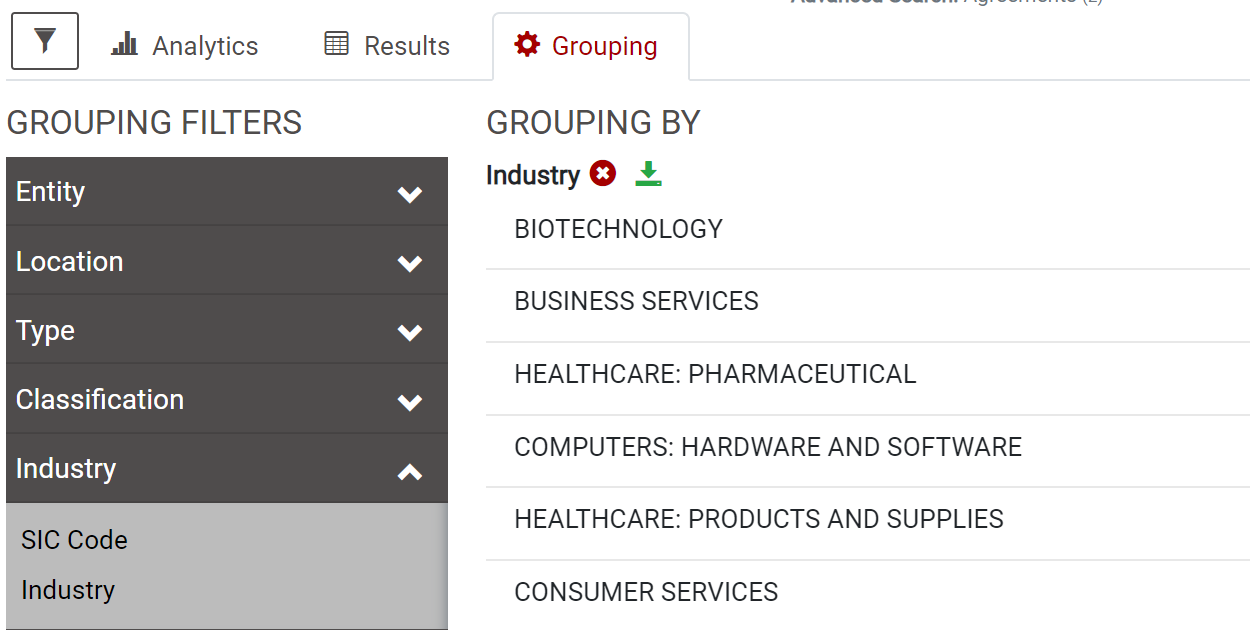

Within the ktMINE database, there is the ability to view only the agreements with valuable information attached, such as the royalty rates. Filtering a search in the Agreements App with an “All Fields, Text Search” of “technology,” the analytics show that the industries containing the most tech agreements with royalty rates are Biotechnology, Business services, and Healthcare: Pharmaceuticals. Given the cost of R&D for drugs, it isn’t surprising to find more companies are collaborating and licensing within the pharmaceutical industry. Computers: Hardware and Software, ranks at number four. Our analytics confirms that most technology-related agreements with royalties are based on a percentage of net revenue, standardized in our product as “net sales.” Let’s look at what royalty agreements we can find related to these emerging technologies.

Artificial Intelligence

Among the three emerging tech areas, AI has the greatest amount of royalty agreements. The average royalty rate was slightly lower than the overall technology average found within our database.

Source: ktMINE Agreements Application

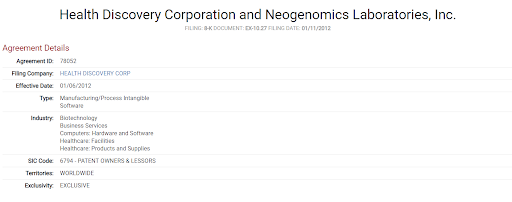

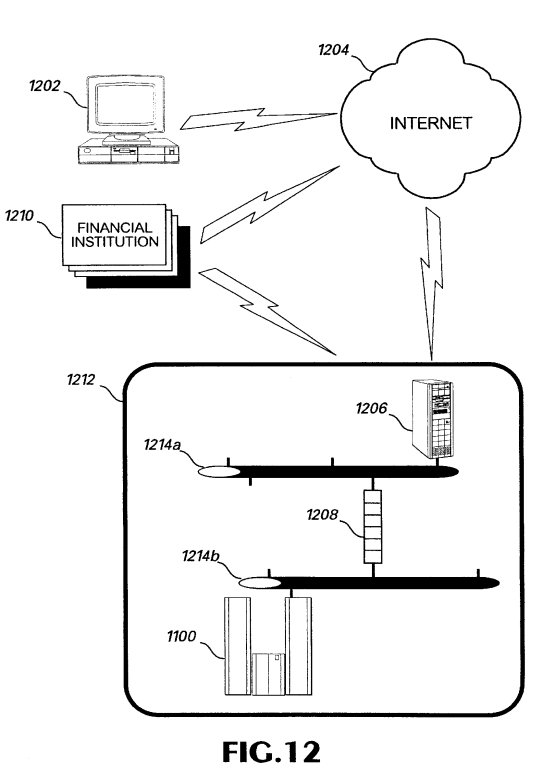

In the first agreement we will look at, machine learning was the technology behind various lab tests licensed from Health Discovery Corporation licensed to Neogenomics Laboratories, Inc. This technology consists of a type of algorithm called a support vector machine (SVM). According to the stated “Licensed Use,” SVM enables the “Laboratory Developed Tests” to diagnose, rule out, predict treatment response, and/or monitor treatment related to cancer. A patent from this agreement is titled “Enhancing knowledge discovery using support vector machines in a distributed network environment” (image below). The royalty rate for the exclusive use of the know-how is applied only after the licensee has “cumulatively generated Twenty Million Dollars” in net sales.

This diagram illustrates one embodiment of the transmission of data from a customer (labeled 1202) to a learning machine that may comprise of SVMs, BSVPs (Biowulf Support Vector Processor which provides the power to expedite SVM training and evaluation on large-scale data sets (1100)). Source: ktMINE Patents App

Another agreement demonstrates the application of AI to smartphones. The license from Artificial Life, Inc. to Buena Vista Internet Group is for an interactive, mobile, story game based on AI. Called “V-girl – your virtual girlfriend Volume I” and “V-boy – your virtual boyfriend Volume I,” the game involves caring for and “dating” virtual characters. However, the royalties for this agreement are an outlier. The royalty rate is a large fraction of the “Product Placement Fees” and “Net Cumulative End User Fees,” both categorized under net sales. The royalty rate in this agreement is higher than the previous agreement likely due to the license including the right to perform distribution services.

Virtual/Augmented Reality

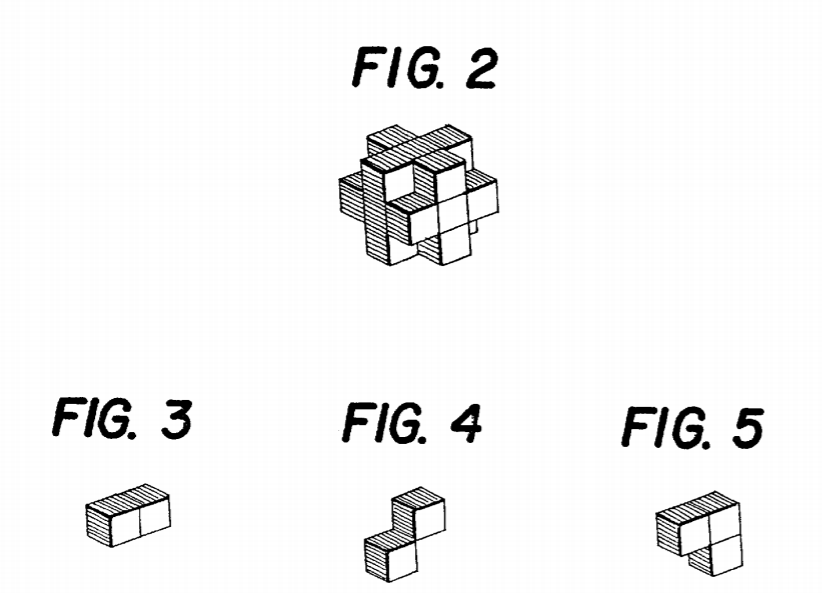

About a quarter of the total amount of Virtual/Augmented Reality agreements contain royalties, with the average being much higher than both AI and the overall average. Like AI, AR/VR also offers an intersection of emerging technology and the medical field. Along with other patents, “System and Method For 4D Reconstruction and Visualization” was licensed to VirtualScopics, LLC from the University of Rochester. This technology forms four-dimensional displays of 2D images received from MRIs. The 4D image can even be “rendered and interacted with in a four-dimensional virtual reality environment.” This was licensed for “research and education” at a percentage of VirtualScopics’ sublicense net sales.

“System and Method For 4D Reconstruction and Visualization” image from patent. Source: ktMINE Patents App

In the intersection of the Entertainment and Computers: Hardware and Software industries is 3D imagery and training software made by a VR company with royalties based on net sales of units sold. The higher rates found in VR/AR is possibly influenced by the higher cost of creating the software and animations that run on VR headsets.

Blockchain

Last, and also least in royalty rate results is blockchain. The increase in related keywords for blockchain gave a much higher result than VR and AI, most of which came from the word “ledger” alone. The average royalty rate was slightly above average, though lower than VR. This low result count may be due to the relative recency of blockchain, having origins dating back to 2008.

Among the agreements that contained the word “blockchain,” a recent one is the licensing of an index called “Indxx Blockchain Index” to First Trust Advisors LP from Indxx LLC. In a presentation by Indxx, the licensed technology “tracks the performance of listed common stocks of companies with their primary listing in Developed or Emerging market countries that are either actively using, investing in, developing, or have products that are poised to benefit from blockchain technology.” This product has an annual fee of a percentage of the “Average Daily Net Assets.” The other “blockchain” agreement is between Black Cactus Holdings, LLC and Envoy Group Corp. for material regarding the building of a crypto trading exchange, supporting crypto, and fiat currencies, music publishing, distribution, supply chain, medical research, and trials.”

Why Aren’t There More?

Each of these emerging technologies has a unique value associated with their agreements, and all but AI were above the technology royalty rate average. Given the current relevance of the knowledge behind the discussed licenses, it is reasonable to find their value reflected in royalty rates. With all this royalty comparison taken into account, royalties are decided (and therefore vary) on a party-to-party basis, so the average is a moving target. For a deeper dive into the other facets of emerging technologies, watch our “Emerging Technologies: Strengthen your business strategy through IP” webinar.