This is the second installment in our series highlighting the different areas to investigate in an effort to strengthen your company’s IP research strategy. In part one, we discussed the importance of having a pulse on emerging technologies. In this post, we will dive deeper into how analyzing the IP behind transacted technologies will give you insight into possible threats and opportunities.

Taking a Look at Packaging

Amcor is a world-leading packaging company, headquartered in Zürich, Switzerland, that develops, manufactures, and sells various packaging products for food and beverage, medical, along with a number of other consumer goods. Amcor produces two types of packaging – flexible and rigid. Liners, pouches, and bags made from film, plastic, paper, or foil would fall under the flexible umbrella, whereas tin cans, cardboard, or plastic/glass containers would fall under rigid packaging.

Bemis, on the other hand, is a global manufacturer of flexible packaging products, headquartered in Neenah, Wisconsin. Bemis manufactures cook-in-bag packaging, shelf-stable packaging, vacuum packaging, and sterile medical packaging, among others.

Amcor is an established leader in flexible packaging and rigid plastics, so why would Amcor invest nearly 7 billion dollars with Bemis? Let’s take a look at the IP portfolios of each company for more insight.

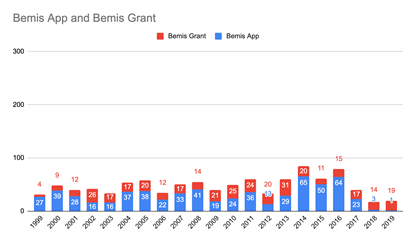

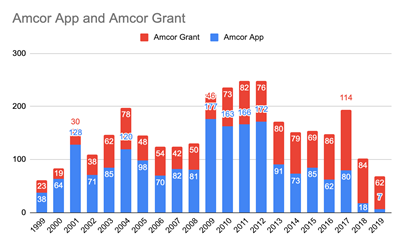

Filing and Grant Trends

By analyzing the patent application filing trends, we can see that Amcor has two to three times more assets than Bemis in any given year. It is certainly possible that Amcor has more filings due to it being a much larger company – 48,000 employees, compared to Bemis’ 16,000. From purely a numbers perspective, it doesn’t appear that Amcor gains strategically from the acquisition, so what was the motivation?

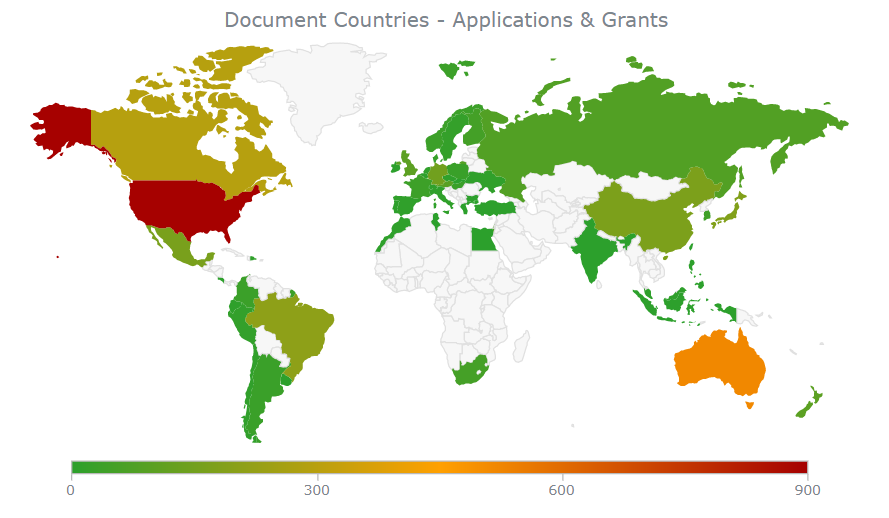

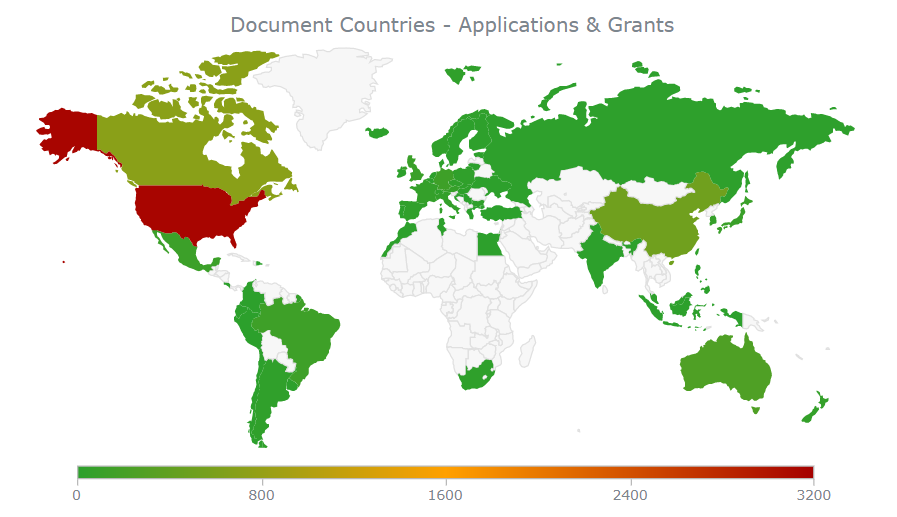

Territory Applications

Bemis:

Amcor:

Geographically speaking, Bemis has a global IP footprint, focusing its efforts mainly in the United States and Canada, with some emphasis in Australia and China. Similarly, Amcor emphasizes filing activity in North America, but, comparatively speaking, their filings are a bit less concentrated in this area than for Bemis. Upon careful inspection, you may observe that Amcor might be interested in Bemis’ filings in Argentina and Ireland (where Amcor has limited exposure). One could also argue that Amcor is seeking more strength in the North American market, but are these arguments strong enough to justify a $7 billion dollar investment?

Technology Areas – Grants

Taking a look at the top ten technology areas of the two companies, we see that Amcor (~43%) and Bemis (~58%) share the same top three innovation areas, which makes the acquisition seem like a natural fit. As an aside, judging by the “Other” bucket which is close to 34%, we note that Amcor is more diverse technologically.

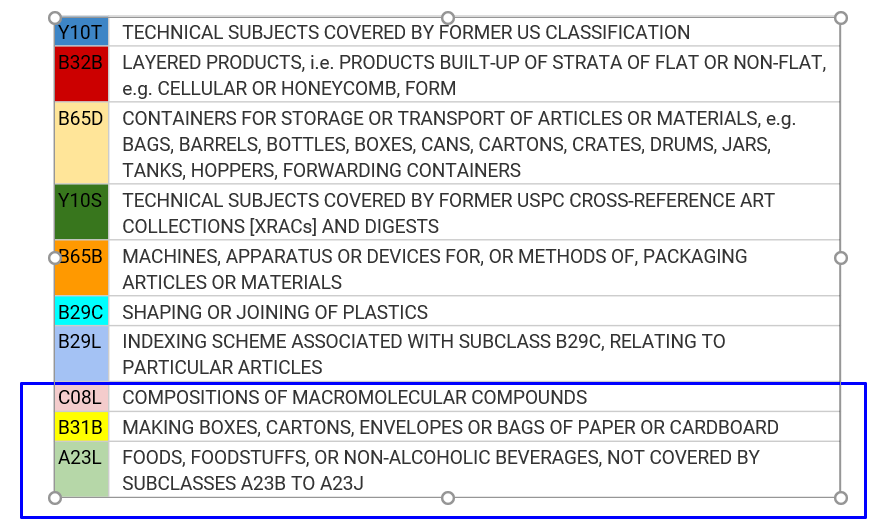

However, when we take a look at the areas that differ, there may be some clues as to the motivation of Amcor acquiring Bemis. The innovation areas (seen above) of particular interest include C08L, B31B, A23L. These are the areas that show up in the top ten for Bemis but are not found in Amcor’s top ten innovation areas.

Quick Look at Y10T for Bemis

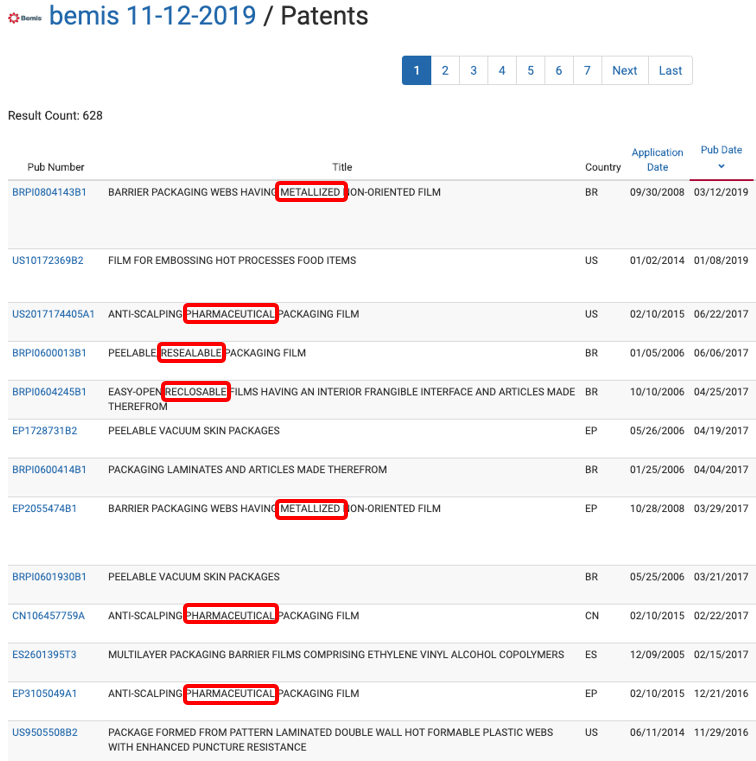

By taking a look at Bemis’ recent grants, we can harvest keywords like “Metallized”, “Pharmaceutical”, “Resealable”, and “Reclosable”. Taking it a step further and digging into “Metallized”, we find evidence that the term is related to sustainability which is currently a hot topic globally for two reasons: recycling efforts and cost. It is extremely attractive to the consumer to sell a product that is environmentally sustainable.

Sustainable Packaging

Amcor highlights its products on a “Sustainable Packaging” page, all of which are former Bemis brands, with “BMET Metallized” garnering specific attention. More is going on than just acquiring market share, geographic position in Argentina and Ireland, or shoring up North America, although, these are still added bonuses. We can now see that the transaction was related to the technology, which enables Amcor to exploit an advantageous position, and, as sustainable themes are becoming extremely relevant, at a good time. The bottom line is Amcor might not have had the time to develop the technology organically – leveraging timeshifting and taking advantage of Bemis and their sustainable products.